Informing Today, Inspiring Tomorrow

Informing Today, Inspiring Tomorrow

Source: IACA

Why the Kina Is Weak, And What It Means for the Country

For many Papua New Guineans, the value of the Kina is no longer an economic concept discussed only by bankers and economists. It is felt every time fuel prices rise, imported food becomes more expensive, or businesses struggle to pay overseas suppliers. Over recent years, the Kina has steadily weakened against the US dollar and other major currencies, raising important questions about why this is happening and what it means for the country’s economy and people.

The depreciation of the Kina is not the result of a single policy decision or global shock. Rather, it reflects long-standing structural challenges in Papua New Guinea’s economy, compounded by recent exchange rate reforms, foreign exchange shortages, and global economic forces. While a weaker currency can offer some advantages, particularly for exporters, its costs are increasingly visible in everyday life.

A Currency Under Pressure

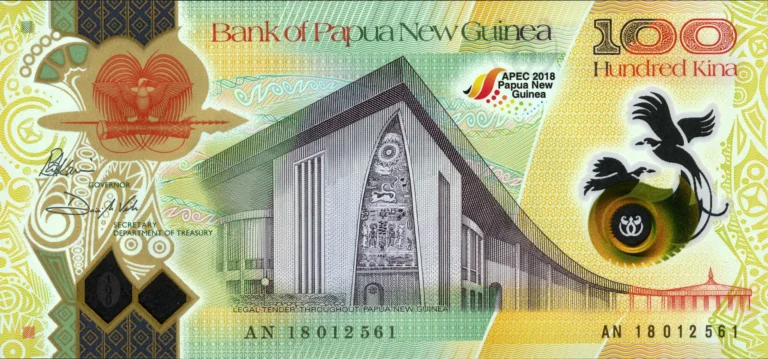

Papua New Guinea operates a managed exchange rate system overseen by the Bank of Papua New Guinea (BPNG). For many years, the Kina was held at a relatively stable level against the US dollar through administrative controls and foreign exchange rationing. While this approach provided short-term stability, it also masked deeper imbalances in the economy.

In 2024, BPNG embarked on a transitional exchange rate reform as part of a broader economic stabilisation program supported by the International Monetary Fund (IMF). The reform aimed to restore foreign exchange convertibility, reduce persistent shortages of US dollars, and allow the Kina to better reflect market fundamentals. As controls were gradually eased, the Kina depreciated, the National Research Institute PNG highlighted that it fell by more than 8 percent against the US dollar within the first year of the transition.

Economists argue that this depreciation was not unexpected. The Kina had been overvalued under the previous system, creating artificial stability while demand for foreign currency continued to exceed supply.

Foreign Exchange Shortages at the Core

At the heart of the Kina’s weakness lies a chronic shortage of foreign exchange. Papua New Guinea imports a significant share of its fuel, machinery, medical supplies, construction materials, and processed food. These imports require payment in foreign currency, primarily US dollars.

However, foreign exchange inflows have not kept pace with demand. Outside of large resource projects such as liquefied natural gas and mining, Papua New Guinea’s export base remains narrow. Agriculture, manufacturing, and tourism — sectors that typically generate diversified foreign earnings — contribute relatively little to overall export receipts.

As a result, businesses have often faced long delays in accessing foreign currency through the banking system. According to economic analysts, outstanding foreign exchange orders have at times reached billions of kina, reflecting persistent unmet demand for US dollars and other hard currencies.

This imbalance places sustained downward pressure on the Kina. When demand for foreign currency consistently exceeds supply, the domestic currency weakens, particularly when administrative controls are relaxed.

Dependence on Resource Exports

Papua New Guinea’s economy is heavily dependent on extractive industries. While LNG, oil, gold, and copper generate substantial export revenue, they also expose the country to global commodity price cycles. When prices fall or production is disrupted, foreign exchange inflows decline sharply.

Moreover, a significant portion of revenue from large resource projects does not immediately circulate within the domestic economy. Foreign debt servicing, profit repatriation, and offshore financing arrangements can limit the amount of foreign currency retained onshore, reducing its stabilising effect on the Kina.

Development economists have long warned that reliance on a small number of capital-intensive projects leaves the currency vulnerable and weakens the link between export earnings and broad-based economic growth.

Global Forces and a Strong US Dollar

The Kina’s depreciation must also be viewed in a global context. In recent years, the US dollar has strengthened against many currencies worldwide, driven by higher interest rates, global uncertainty, and its role as a safe-haven currency.

Even well-managed economies have seen their currencies lose ground against the US dollar. For a developing economy like Papua New Guinea, with limited foreign reserves and a narrow export base, these global pressures are magnified.

Analysts note that the Kina’s weakness is partly a reflection of global dollar dominance rather than domestic mismanagement alone.

What a Weak Kina Means for Ordinary Papua New Guineans

For households, the most immediate impact of a weaker Kina is higher prices. Imported goods become more expensive in kina terms, feeding into inflation across the economy. Fuel price increases affect transport costs, electricity generation, and food distribution, pushing up the cost of living.

Low-income households are particularly vulnerable, as they spend a larger share of their income on essentials such as food, transport, and energy. Wage growth rarely keeps pace with inflation driven by currency depreciation, eroding purchasing power over time.

For students studying overseas, families supporting relatives abroad, or patients seeking medical treatment offshore, the cost of accessing foreign currency has risen significantly, placing additional strain on household finances.

Impact on Business and Investment

Businesses that rely on imported inputs face rising costs and uncertainty. Manufacturers, retailers, and construction firms must either absorb higher costs or pass them on to consumers. Delays in accessing foreign exchange can disrupt supply chains, stall projects, and reduce productivity.

Foreign investors, meanwhile, view currency volatility as a risk. While some depreciation can improve competitiveness, persistent weakness combined with foreign exchange shortages can deter long-term investment. According to private sector analysts, uncertainty around currency access remains one of the biggest constraints to doing business in Papua New Guinea.

Government Debt and Fiscal Pressure

A weaker Kina also affects public finances. Much of Papua New Guinea’s external debt is denominated in foreign currency. When the Kina depreciates, the cost of servicing this debt rises in local currency terms, placing pressure on the national budget.

This can reduce fiscal space for spending on health, education, infrastructure, and law and order. While exchange rate reform aims to restore long-term stability, the short-term fiscal impact can be significant, particularly when combined with rising global interest rates.

Are There Any Advantages to a Weak Kina?

Despite its challenges, a weaker Kina is not without potential benefits.

Export Competitiveness:

In theory, depreciation makes exports cheaper for foreign buyers. Exporters earn more kina for every US dollar received, which can improve profitability and encourage production. For agriculture, fisheries, and tourism, this could enhance competitiveness if supporting infrastructure and policies are in place.

Import Substitution:

Higher import prices can create incentives for local production, encouraging domestic manufacturing and food production. Over time, this can reduce reliance on imports and strengthen economic resilience.

Correcting Overvaluation:

Economists argue that allowing the Kina to reflect market conditions helps correct distortions created by prolonged currency controls. A realistic exchange rate can improve foreign exchange allocation, reduce backlogs, and restore confidence in the financial system.

IMF Assessment and Recent Reforms

In December 2025, the International Monetary Fund completed key reviews under Papua New Guinea’s Extended Credit Facility, Extended Fund Facility, and Resilience and Sustainability Facility, unlocking about US$219 million in new financing and bringing total IMF support since 2023 to roughly US$851 million. The IMF confirmed that the programs were designed to address long-standing balance-of-payments pressures, including persistent foreign exchange shortages.

The Fund noted that economic growth is projected to reach 4.5 percent in 2025, supported by increased resource production and resilient non-resource sector activity, while inflation is expected to normalise after a low base in 2024. Importantly, the IMF confirmed that access to foreign exchange has improved significantly in recent months due to central banking reforms, increased flexibility of the Kina, and favourable external conditions. However, it emphasised that exchange rate flexibility alone is not sufficient without supporting fiscal discipline, tighter monetary policy, stronger governance, and climate resilience measures to secure long-term economic stability.

The Road Ahead

Strengthening the Kina in a sustainable way will require more than exchange rate adjustments. Policymakers face the challenge of expanding export diversification, improving foreign exchange inflows, supporting small and medium-sized enterprises, and building confidence in the financial system.

For Papua New Guineans, the value of the Kina ultimately reflects the strength of the economy behind it. This will require productivity to rise, exports to diversify, and improvements in foreign exchange supply to ease pressure on the Kina. What matters most is how the transition is managed — ensuring that reforms protect vulnerable households, support businesses, and lay the foundation for long-term economic resilience.